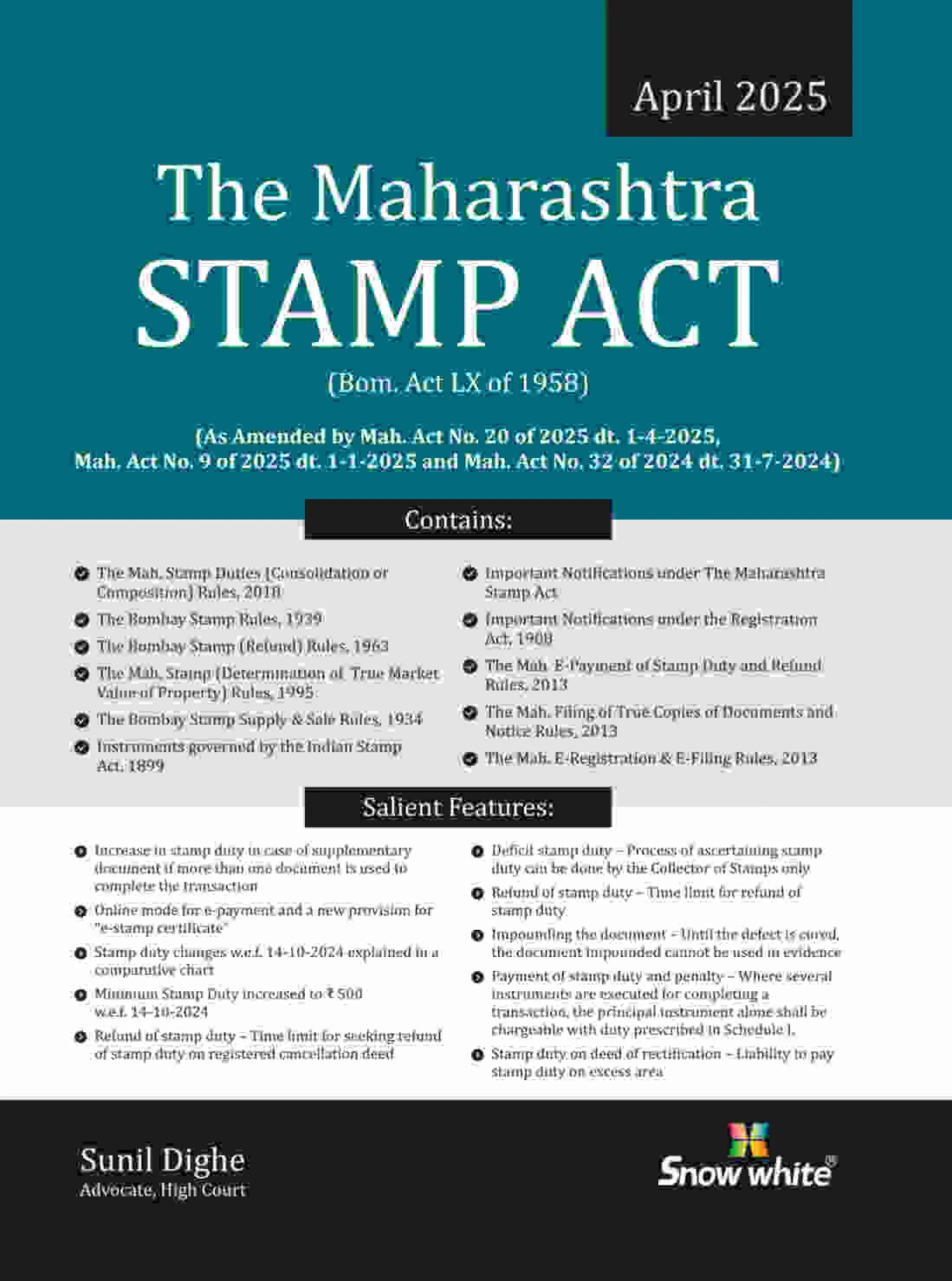

The Maharashtra Stamp Act

₹1,595.00 Original price was: ₹1,595.00.₹1,276.00Current price is: ₹1,276.00.

This book provides the full and updated text of the Maharashtra Stamp Act, offering a thorough understanding of stamp duty chargeability, valuation, exemptions, and compliance requirements for various legal documents. It outlines essential procedures for property transactions, agreement execution, adjudication, penalties, and registration-related obligations. An indispensable reference for legal professionals, real estate practitioners, auditors, and anyone involved in document stamping and registration in Maharashtra.

In stock

| Authors of Books | Sunil Dighe |

|---|

You may also like it

-

Unified Development Control And Promotion Regulations For Maharashtra

₹1,395.00Original price was: ₹1,395.00.₹1,116.00Current price is: ₹1,116.00. -

Treatise On The Insolvency And Bankruptcy Code, 2016 (Law And Practice) In 2 Volumes

₹7,995.00Original price was: ₹7,995.00.₹6,396.00Current price is: ₹6,396.00.

This authoritative edition of the Maharashtra Stamp Act offers a comprehensive presentation of the statutory rules governing stamp duty on legal, commercial, and property-related documents in Maharashtra. The Act is central to the administration of revenue law and affects virtually every transaction that requires documentation—particularly agreements for sale, conveyances, mortgages, leases, power of attorney, partnership deeds, and other instruments. The book provides a clear, section-wise layout of the law, including detailed schedules specifying stamp duty rates, valuation guidelines for properties, chargeability rules, provisions for voluntary adjudication, penalties for insufficient stamping, and the powers of the Collector of Stamps. It also explains procedures for validating documents, impounding unstamped or inadequately stamped instruments, and steps for refund of stamp duty in eligible cases. Structured for professional use, this Bare Act serves as a vital tool for lawyers, government officers, real estate developers, auditors, tax consultants, and law students. Its precision and completeness make it indispensable for drafting property documents, ensuring compliance during registration, handling stamp adjudication matters, and navigating both transactional and courtroom processes.

| Authors of Books | Sunil Dighe |

|---|

Featured Products

Important Civil Acts covering 15 Acts

🔥 2 items sold in last 7 days

Criminology & Penology

🔥 2 items sold in last 7 days

Interpretation of Statutes

🔥 2 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.