Gst Manual With Gst Tariff In 2 Volumes

₹2,595.00 Original price was: ₹2,595.00.₹2,076.00Current price is: ₹2,076.00.

A definitive two-volume practitioner reference combining GST law, procedural guidance and a complete tariff compendium (HSN/SAC) with current rates and valuation rules. Volume I focuses on legal interpretation, compliance workflows, ITC, returns, assessments and dispute-resolution; Volume II provides exhaustive tariff classification, rate tables, illustrative classification examples and practical guidance on ambiguous items. The set includes templates, sample notices, reconciliation formats and quick-reference charts to streamline compliance and classification tasks.

In stock

| Authors of Books | Ca Vineet Sodhani & Ca Deepshikha Sodhani |

|---|

You may also like it

-

Unified Development Control And Promotion Regulations For Maharashtra

₹1,395.00Original price was: ₹1,395.00.₹1,116.00Current price is: ₹1,116.00. -

Treatise On The Insolvency And Bankruptcy Code, 2016 (Law And Practice) In 2 Volumes

₹7,995.00Original price was: ₹7,995.00.₹6,396.00Current price is: ₹6,396.00.

GST Manual with GST Tariff — 2 Volumes is an exhaustive, desk-ready resource for tax practitioners, accountants and compliance teams. Volume I explains GST law and practice: registration, invoicing, time & value of supply, input tax credit mechanics, return filing and reconciliation, audit & assessment procedures, refund claims, recovery and dispute-resolution strategies. It provides flowcharts, sample replies to notices, checklists and worked illustrations for practical application. Volume II acts as a tariff compendium: complete HSN/SAC listings, current rate tables, classification principles, valuation FAQs and numerous illustrative classification case studies that resolve commonly contested descriptions. Both volumes include quick-reference annexures (rates by sector, exempted items, negative list), specimen templates (invoices, shipping docs, reconciliation worksheets), and an indexed search system for rapid lookup. Designed to reduce classification errors and compliance risk, the set helps users select correct rates, substantiate ITC positions, respond to audits, and speed up return reconciliation. Updated editions can incorporate rate and notification changes so practitioners remain audit-ready. This combination of legal guidance and an authoritative tariff makes the title indispensable for everyday GST operations and contentious cases.

| Authors of Books | Ca Vineet Sodhani & Ca Deepshikha Sodhani |

|---|

Featured Products

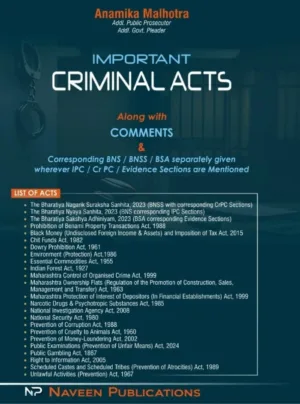

Important Civil Acts covering 15 Acts

🔥 2 items sold in last 7 days

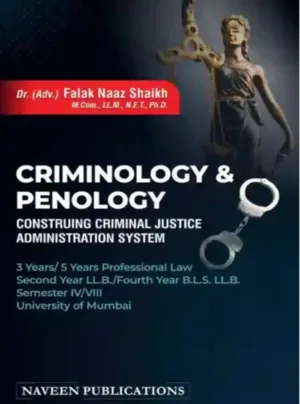

Criminology & Penology

🔥 2 items sold in last 7 days

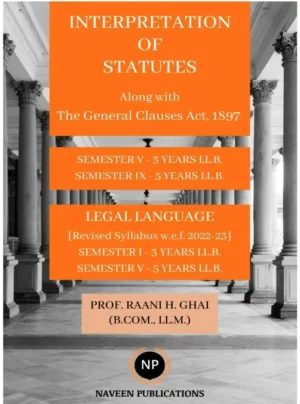

Interpretation of Statutes

🔥 2 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.