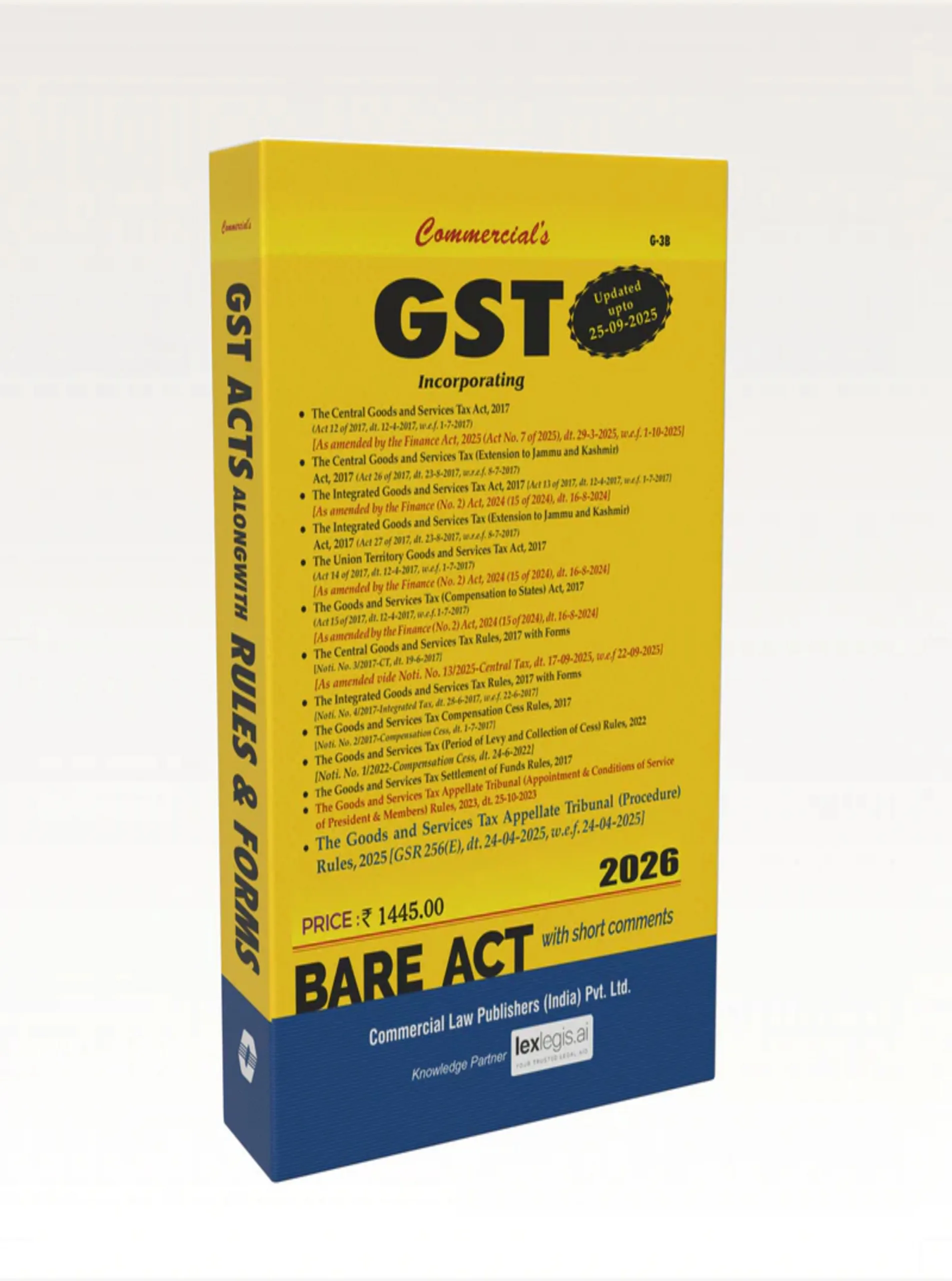

GST Acts and Rules, 2017 with Forms

₹1,445.00 Original price was: ₹1,445.00.₹1,156.00Current price is: ₹1,156.00.

GST Acts & Rules, 2017 with Forms compiles the central GST statutes and the corresponding Rules side-by-side with the official Forms, turning raw law into a single, usable desk reference. Each section includes concise annotations, cross-references between sections and rules, and model drafts to support filing and compliance. The volume is structured for fast lookup during month-end reconciliations, advisory work, and exam revision.

In stock

You may also like it

-

The Criminal Law (Amendment) Act, 2018

₹130.00Original price was: ₹130.00.₹104.00Current price is: ₹104.00. -

The Companies Act, 2013 (AIBE)

₹495.00Original price was: ₹495.00.₹396.00Current price is: ₹396.00.

GST Acts & Rules, 2017 with Forms is a statute-first compendium that places each GST Act alongside the consolidated Rules and the official Forms used across registration, returns, invoicing and compliance. The book reproduces operative sections from CGST/IGST/UTGST/Compensation Acts, followed immediately by the relevant Rules and their designated Forms (e.g., REG-06, GSTR series, CMP forms and e-invoice/IRN forms), enabling instant correlation between law and procedure. Concise annotations explain scope, definitions, and operative mechanics (registration, ITC, reverse charge, composition, refunds, assessments), while flowcharts, checklists and model drafts convert legal provisions into practical tasks for filing and audits. Included is a clear Forms Directory with short notes on purpose, who files it, frequency and portal references — invaluable for month-end teams and practitioners. Carefully curated indexing and a keyword TOC speed retrieval by section, rule or form. Whether used for exam preparation, advisory work or corporate compliance, this volume reduces lookup time and lowers filing risk by combining statute, delegated rules and forms in one trusted resource. (Official statute & rules sources: CBIC & IndiaCode).

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 5 items sold in last 7 days

Interpretation of Statutes

🔥 7 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.