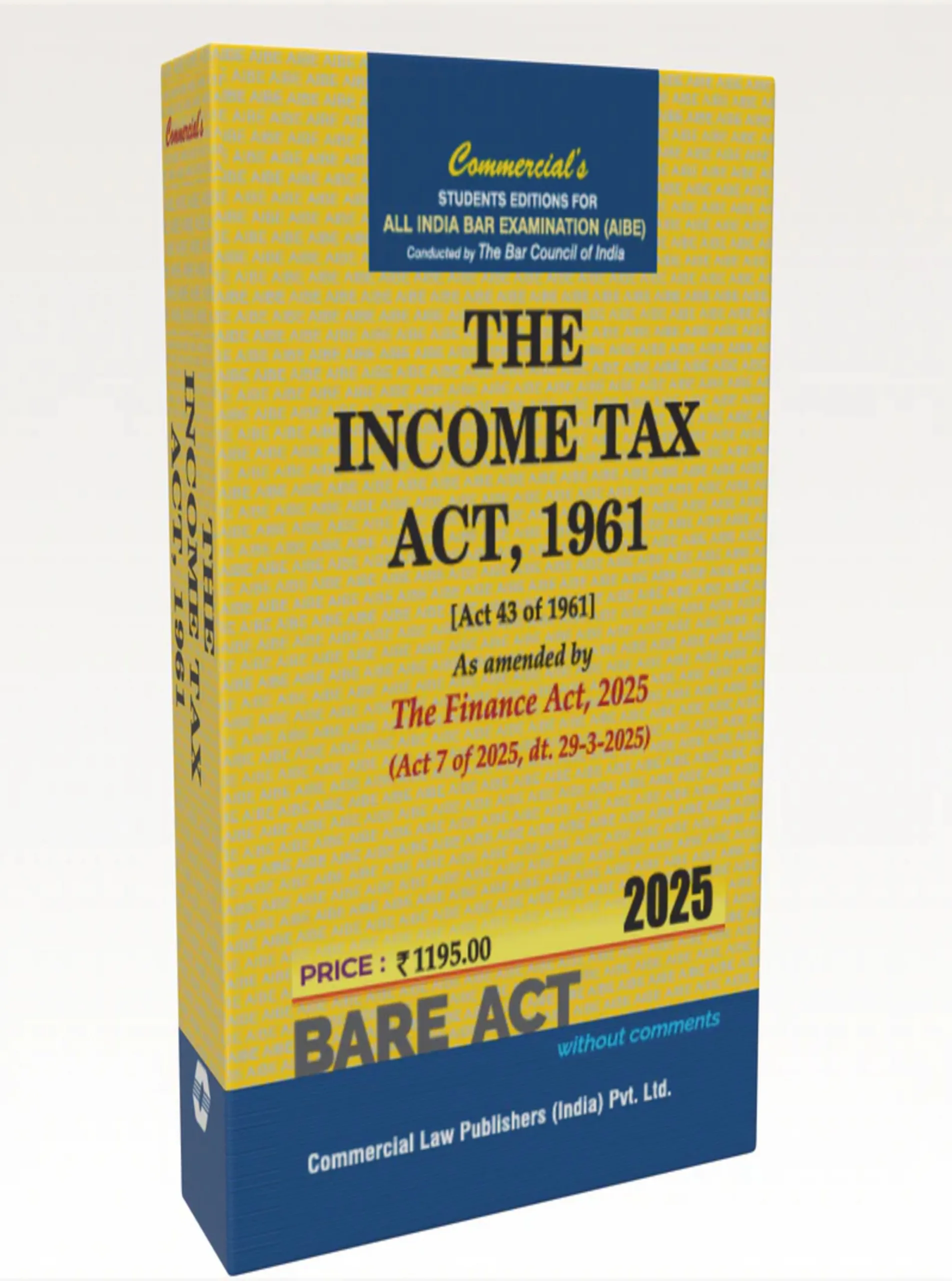

The Income Tax Act, 1961 (AIBE)

₹1,195.00 Original price was: ₹1,195.00.₹956.00Current price is: ₹956.00.

This book provides an authoritative commentary on the Income Tax Act, 1961, with special emphasis on provisions relevant for AIBE examinations. It explains tax compliance, procedures, and legal interpretations to help lawyers and students navigate Indian taxation law effectively. Designed as a practical guide, the book integrates case law and statutory provisions to ensure clarity and applicability in real-world scenarios.

In stock

You may also like it

-

The Criminal Law (Amendment) Act, 2018

₹130.00Original price was: ₹130.00.₹104.00Current price is: ₹104.00. -

The Companies Act, 2013 (AIBE)

₹495.00Original price was: ₹495.00.₹396.00Current price is: ₹396.00.

The Income Tax Act, 1961 (AIBE) is an essential legal text providing an in-depth commentary on India’s income taxation framework. This book covers all major provisions of the Act, including tax computation, filing procedures, assessment, penalties, and appeals, with a special focus on AIBE-relevant content. It integrates statutory provisions with judicial interpretations and practical examples to provide readers with a thorough understanding of Indian income tax law.

The commentary highlights key compliance requirements, corporate and individual tax obligations, and procedural nuances crucial for legal practice. Case law analyses and illustrations clarify complex concepts such as capital gains, exemptions, deductions, and assessments. Designed to bridge theory and practice, this book serves as a valuable reference for lawyers handling taxation matters, students preparing for the AIBE examination, and professionals advising on corporate tax compliance.

Structured for clarity, the book simplifies complicated statutory language and procedural requirements while ensuring comprehensive coverage of amendments, notifications, and circulars. Its focus on practical applicability and exam-oriented content makes it indispensable for those seeking expertise in Indian taxation law.

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 5 items sold in last 7 days

Interpretation of Statutes

🔥 7 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.