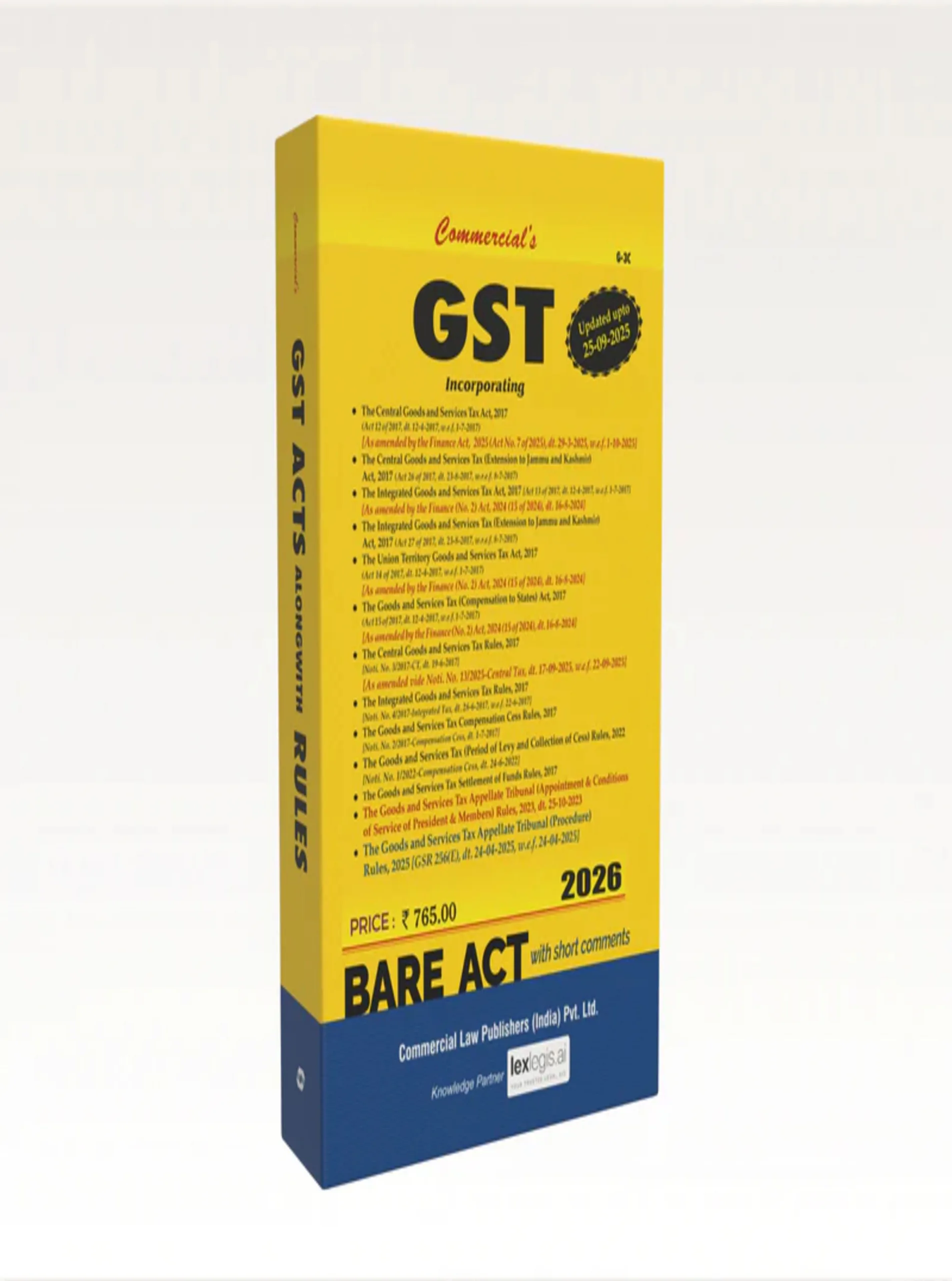

GST Acts alongwith Rules

₹765.00 Original price was: ₹765.00.₹612.00Current price is: ₹612.00.

GST Acts alongwith Rules brings together the full text of principal GST statutes and their corresponding rules in a single, easy-to-use volume, with section-wise notes and rule cross-references. The book adds plain-language annotations, procedural flowcharts and model forms to convert statutory text into actionable compliance steps. It is designed for quick lookup during advisory work, returns filing and examination preparation.

In stock

You may also like it

-

The Criminal Law (Amendment) Act, 2018

₹130.00Original price was: ₹130.00.₹104.00Current price is: ₹104.00. -

The Companies Act, 2013 (AIBE)

₹495.00Original price was: ₹495.00.₹396.00Current price is: ₹396.00.

GST Acts alongwith Rules is a practical, statute-first reference that compiles the Central, Integrated and relevant State GST Acts with all allied Rules in one place, accompanied by clear annotations and compliance-focused tools. Each section reproduces the operative statutory provisions followed immediately by the corresponding Rules, with cross-references that make it easy to see how legislation and delegated rules interact. Concise commentary explains key concepts — registration, invoice/e-invoice rules, input tax credit mechanics, reverse charge, composition scheme, returns & refunds, assessment and adjudication procedures — and highlights typical areas of compliance risk. The book includes flowcharts that map routine processes (e.g., GST registration, ITC reconciliation, return filing), model forms and notices, a checklist for quarterly and annual compliance, and short case pointers to recent decisions shaping interpretation. Carefully curated indexing and a keyword-driven table of contents allow rapid retrieval by section, rule or topic. Whether used on the desk of a practicing indirect-tax lawyer, by an in-house tax team during month-end reconciliation, or as a revision aid for students, this compendium turns statute and rules into practical guidance for day-to-day GST operations.

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 5 items sold in last 7 days

Interpretation of Statutes

🔥 7 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.