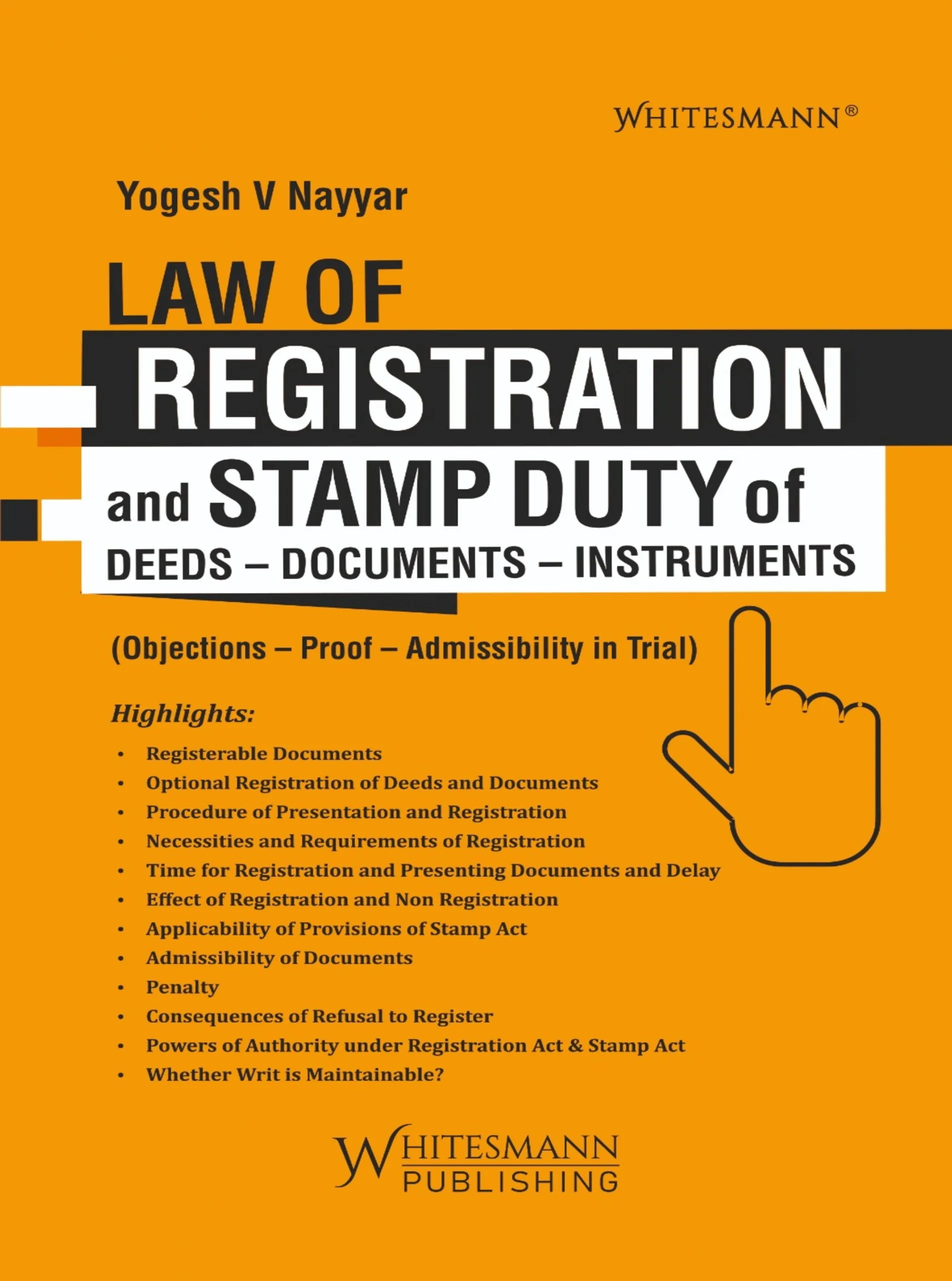

Law Of Registration And Stamp Duty Of Deeds-Documents -Instruments

₹2,970.00 Original price was: ₹2,970.00.₹2,376.00Current price is: ₹2,376.00.

This 2025 edition is a comprehensive practitioner’s treatise on registration and stamp duty law in India, analyzing the Registration Act, 1908 and Stamp Act (and related state rules) with instrument-wise coverage. It explains registration procedure, admissibility issues, valuation and stamp computation, penalties for deficiency and remedies, and modern developments like e-registration. Practical drafting templates, checklists and ready references make it an essential field guide for conveyancers, litigators and registrars.

In stock

| Authors of Books | YOGESH V NAYYAR |

|---|

You may also like it

-

₹2,295.00Original price was: ₹2,295.00.₹1,836.00Current price is: ₹1,836.00. -

New Case Law Referencer on Arbitration and Conciliation Act

₹895.00Original price was: ₹895.00.₹716.00Current price is: ₹716.00.

Law of Registration and Stamp Duty of Deeds-Documents-Instruments (2025) is a practitioner-focused treatise that explains India’s registration and stamp law in a single instrument-wise volume. Beginning with the full text and clause-by-clause commentary on the Registration Act, 1908, the book examines the scope of registrability, offices and officers, vital formalities for immovable-property instruments and mechanics of e-registration. The stamp-law section decodes the Indian Stamp Act and state schedules: stampability of instruments, valuation for duty, adhesive versus e-stamp approaches, and procedures for paying deficit duty and penalties. Instrument-specific chapters (sale deed, agreement to sell, lease, gift, mortgage, partition, power of attorney, release, compromise deed and arbitration award) present drafting checklists, sample clauses, registration check procedures and common pitfalls that lead to inadmissibility. The volume also addresses legal consequences of non-registration, evidentiary limitations, rectification, adjudication of stamp duty, and recent administrative reforms (digital stamping/e-registration). Appendices include specimen forms, sample affidavits, state stamp schedules and a quick reference index of cases and circulars. Designed for lawyers, registrars, property developers and students, the book blends doctrinal clarity with actionable tools to streamline conveyancing, reduce litigation risk and ensure statutory compliance.

| Authors of Books | YOGESH V NAYYAR |

|---|

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 5 items sold in last 7 days

Interpretation of Statutes

🔥 7 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.