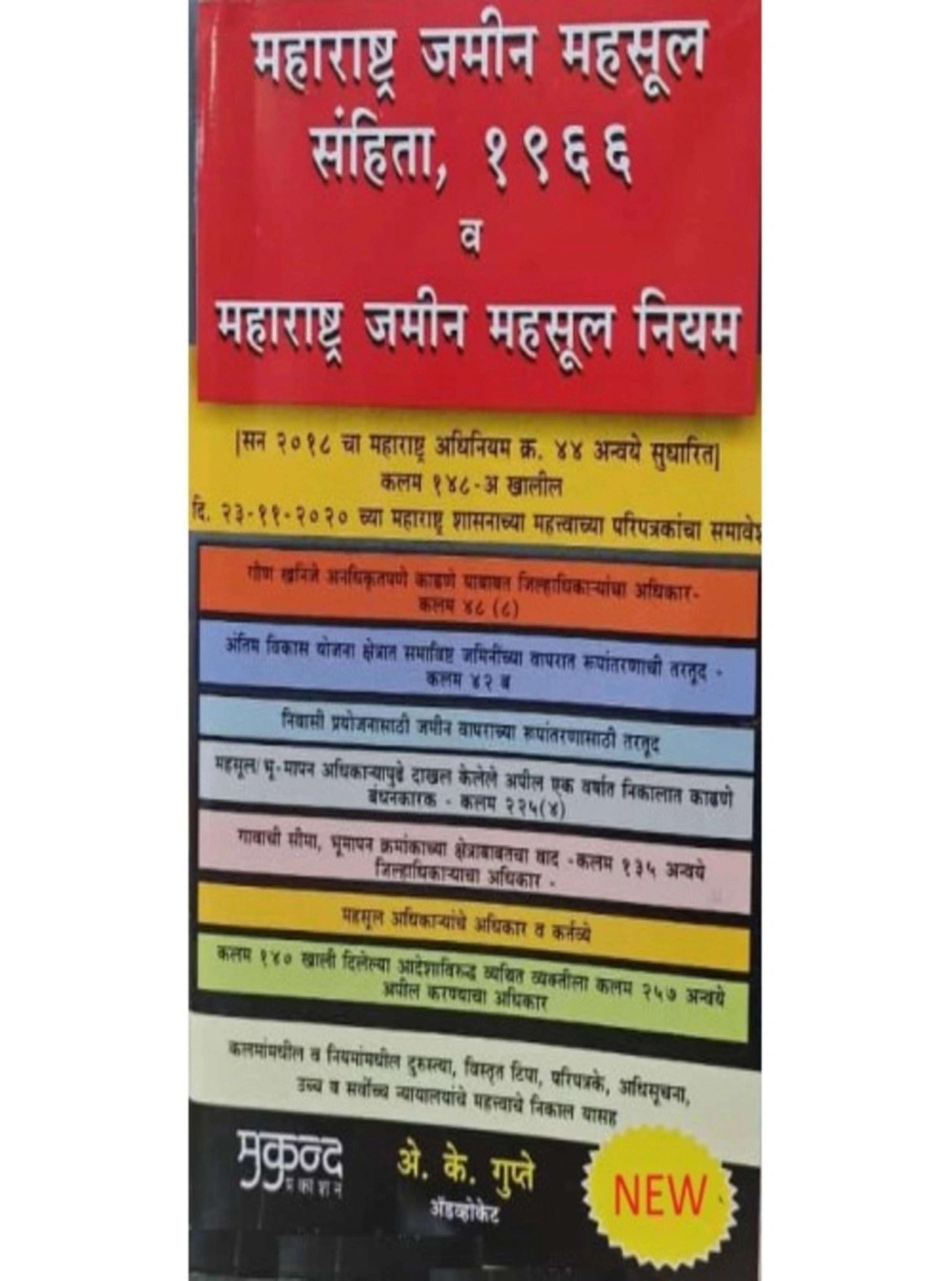

Maharashtra Land Revenue Code, 1966 with Rules

₹1,295.00 Original price was: ₹1,295.00.₹1,165.50Current price is: ₹1,165.50.

This book presents a clear, section-by-section commentary on the Maharashtra Land Revenue Code, 1966 together with the accompanying Rules, explaining statutory provisions and administrative practice. It covers land records maintenance (including 7/12 extracts), mutation procedures, surveys and settlement, assessment, appeals and correction of entries with reference to relevant case law and circulars. Practical checklists, village form guidance and model formats make it invaluable for revenue officers, lawyers and property professionals.

In stock

| Authors of Books | Adv. A. K. Gupte |

|---|

You may also like it

-

₹2,295.00Original price was: ₹2,295.00.₹1,836.00Current price is: ₹1,836.00. -

New Case Law Referencer on Arbitration and Conciliation Act

₹895.00Original price was: ₹895.00.₹716.00Current price is: ₹716.00.

This comprehensive volume provides an authoritative commentary on the Maharashtra Land Revenue Code, 1966, together with the relevant Rules, presenting statutory text, explanatory notes, and practical guidance for day-to-day revenue administration. The book explains essentials such as land records management (7/12 extracts), mutation procedures, preparation and maintenance of village forms, survey and settlement operations, classification and assessment of land, occupancy and cultivation rights, and powers and duties of revenue officers from talathi to Collector. It addresses procedural aspects like registration of entries, correction of records, appeals and revisions, encroachment handling, and disposal of government lands, integrating key judgments, government circulars and specimen formats. Designed for both field officers and legal practitioners, the volume includes model applications, checklists for mutation and revision, flowcharts of procedural steps, and practical tips for resolving common disputes. Special emphasis is placed on bridging statute with field practice — clarifying where rules supplement the Code and illustrating administrative compliance. Whether used in litigation, revenue administration, conveyancing or academic study, this book is a dependable, single-source reference for navigating land law and revenue processes in Maharashtra.

| Authors of Books | Adv. A. K. Gupte |

|---|

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 7 items sold in last 7 days

Interpretation of Statutes

🔥 4 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.