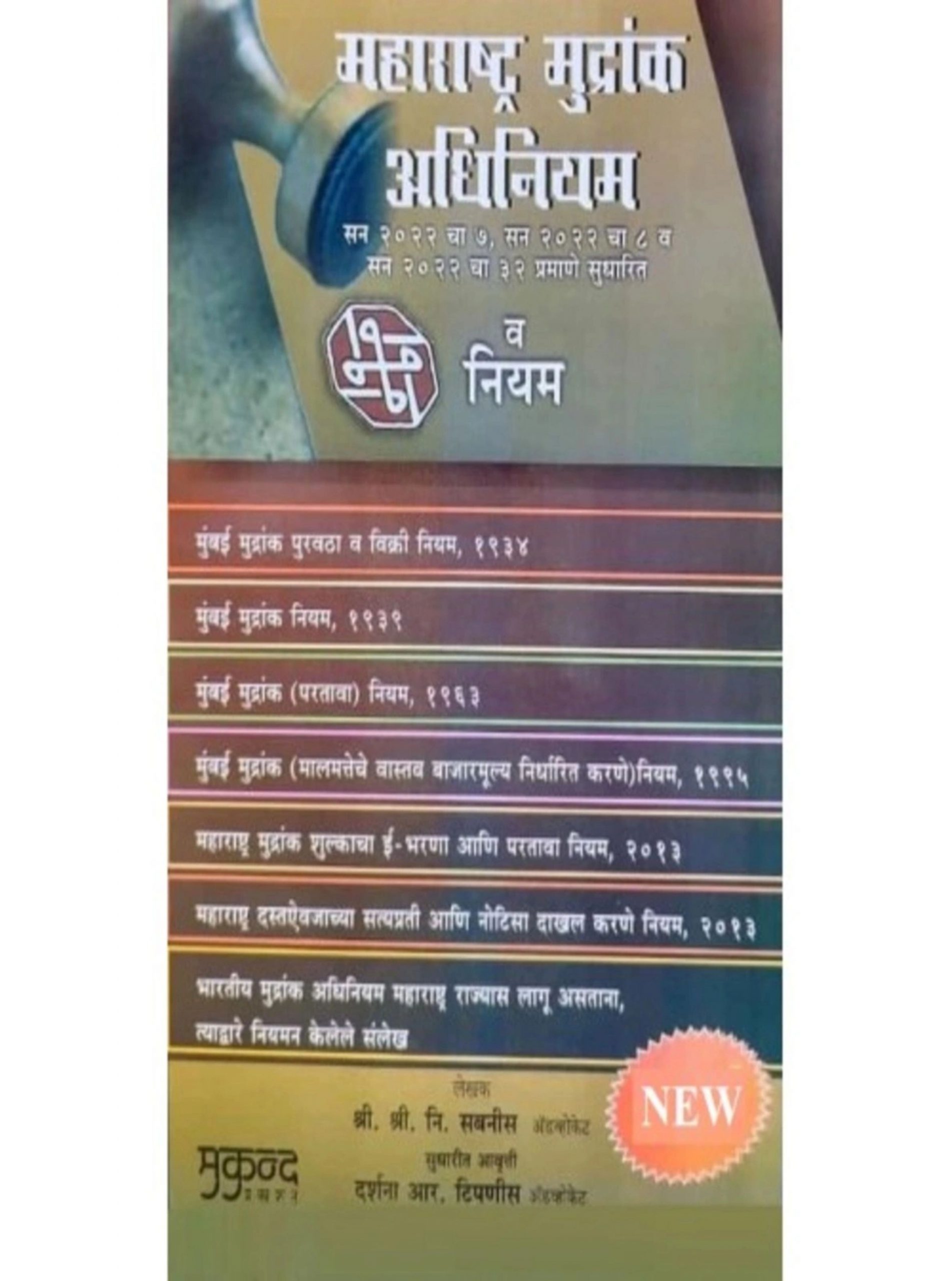

Maharashtra Stamp Act & Rule

₹560.00 Original price was: ₹560.00.₹504.00Current price is: ₹504.00.

This book provides an authoritative commentary on the Maharashtra Stamp Act and the accompanying Rules, explaining provisions related to stamp duty, registration of instruments, and legal compliance in property transactions. It covers calculation of stamp duty, exemptions, penalties, and the process for document execution and registration. Enhanced with case law, practical examples, and procedural guidance, it is an indispensable reference for lawyers, property professionals, and government officials.

In stock

| Authors of Books | Adv. Shri. N. Sabnis |

|---|

You may also like it

-

₹2,295.00Original price was: ₹2,295.00.₹1,836.00Current price is: ₹1,836.00. -

New Case Law Referencer on Arbitration and Conciliation Act

₹895.00Original price was: ₹895.00.₹716.00Current price is: ₹716.00.

This authoritative volume presents a detailed commentary on the Maharashtra Stamp Act along with the Rules, offering a complete understanding of stamp duty regulations and document registration in Maharashtra. The book explains statutory provisions governing payment of stamp duty, calculation of duty on various instruments such as sale deeds, conveyances, leases, and mortgages, as well as applicable exemptions, penalties, and compliance requirements. The commentary integrates case law, government notifications, circulars, and procedural guidance to clarify judicial interpretation and practical implementation. It also provides step-by-step instructions for document execution, registration, and ensuring compliance with the Stamp Act framework. Special emphasis is placed on real-world examples and frequently encountered issues in property transactions to help practitioners and officials avoid disputes or errors in stamp duty matters. Structured for easy reference, this book is indispensable for legal practitioners, property consultants, real estate developers, government revenue officers, and law students. Its clear explanations, practical examples, and procedural insights make it a reliable resource for ensuring proper compliance, smooth property transactions, and understanding rights and obligations under the Maharashtra Stamp Act and Rules.

| Authors of Books | Adv. Shri. N. Sabnis |

|---|

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 7 items sold in last 7 days

Interpretation of Statutes

🔥 4 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.