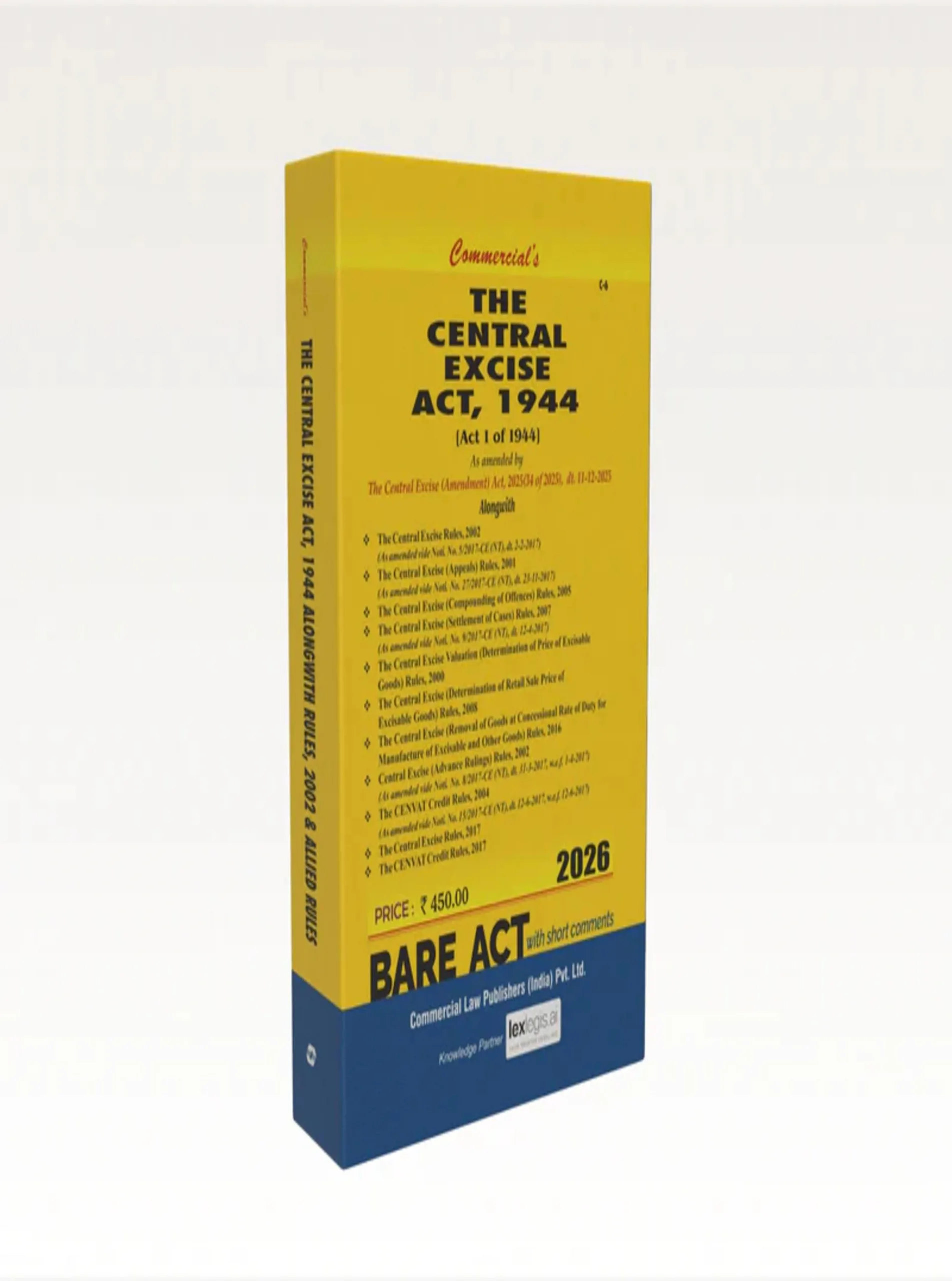

The Central Excise Act, 1944

₹450.00 Original price was: ₹450.00.₹360.00Current price is: ₹360.00.

The Central Excise Act, 1944 forms the backbone of India’s indirect tax regime on the manufacture and production of goods. It governs the levy, assessment, collection, exemptions, and enforcement of excise duties, along with penalties and adjudication mechanisms. This book presents the complete statutory text, making it an essential reference for tax law practice and study.

In stock

You may also like it

-

The Criminal Law (Amendment) Act, 2018

₹130.00Original price was: ₹130.00.₹104.00Current price is: ₹104.00. -

The Companies Act, 2013 (AIBE)

₹495.00Original price was: ₹495.00.₹396.00Current price is: ₹396.00.

The Central Excise Act, 1944 is a landmark legislation that regulated the levy and collection of excise duty on goods manufactured or produced in India, forming a critical component of the country’s indirect tax framework prior to GST. This Act lays down detailed provisions relating to classification, valuation, assessment, exemptions, refunds, and recovery of excise duty, along with enforcement mechanisms.

This publication provides the authentic and updated text of the Act, offering clarity on key aspects such as registration of manufacturers, maintenance of records, inspection, search and seizure, confiscation of goods, and imposition of penalties. It also addresses offences, adjudication, appeals, and revision procedures, ensuring comprehensive statutory coverage.

Despite the introduction of GST, the Central Excise Act continues to remain relevant for specified goods such as petroleum products and tobacco, as well as for legacy disputes and transitional litigation. The book serves as a vital reference for understanding historical and continuing excise liabilities.

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 5 items sold in last 7 days

Interpretation of Statutes

🔥 7 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.