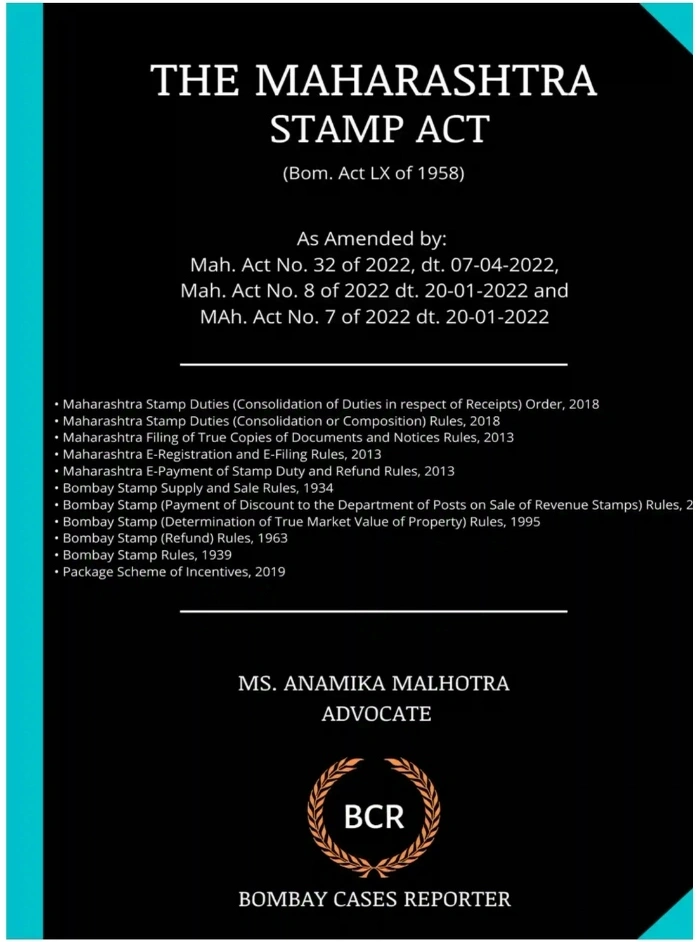

The Maharashtra Stamp Act

₹695.00 Original price was: ₹695.00.₹556.00Current price is: ₹556.00.

This volume consolidates the Maharashtra Stamp Act, 1958 with amendments through 2022, presenting clear duty schedules and procedures for instruments such as conveyances, mortgages, leases, gifts, powers of attorney and works contracts. It explains adjudication (s.31), undervaluation (s.32A), penalties, refunds and market-value computation. Corporate-law users benefit from coverage of stamp duty on court/NCLT/BIFR orders relating to mergers and restructurings. Appendices provide Bombay Stamp Rules 1939, Refund Rules 1963, True Market Value Rules 1995, and e-Payment/e-Registration Rules 2013 for end-to-end compliance.

10 in stock

| Weight | 5 lbs |

|---|---|

| Authors of Books | Anamika Malhotra |

You may also like it

-

₹2,295.00Original price was: ₹2,295.00.₹1,836.00Current price is: ₹1,836.00. -

New Case Law Referencer on Arbitration and Conciliation Act

₹895.00Original price was: ₹895.00.₹716.00Current price is: ₹716.00.

The Maharashtra Stamp Act (Bombay Act LX of 1958) is presented here in a fully consolidated edition updated through 2022. Designed for hands-on use, it maps every major instrument covered by Schedule I—including conveyances, mortgages (simple and by deposit of title deeds), leases and leave-and-licence, gifts, partnership deeds, powers of attorney and works contracts—alongside the governing rates, exemptions and ceilings. Practitioners will find detailed treatment of adjudication (s.31), undervaluation (s.32A), impounding, penalties and refund mechanisms, with step-wise procedural clarity. Real-estate and infrastructure users benefit from rules on market valuation and recent relief under Article 5(g-a)(ii) tailored to unit transfers in registered projects, while corporate users gain definitive guidance on duty for merger, amalgamation and demerger orders passed by courts, NCLT and related authorities now included within “conveyance.” Complementary appendices compile the Bombay Stamp Rules 1939, Refund Rules 1963, True Market Value Rules 1995, and Maharashtra e-Payment and e-Registration Rules 2013, enabling compliant e-stamping and filing. Revised by Ms. Anamika Malhotra and published by Bombay Cases Reporter (BCR), the book integrates statutory text, notifications and practical notes, making it an indispensable reference for due-diligence, drafting and litigation across property, banking and corporate practice.

| Weight | 5 lbs |

|---|---|

| Authors of Books | Anamika Malhotra |

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 5 items sold in last 7 days

Interpretation of Statutes

🔥 7 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.