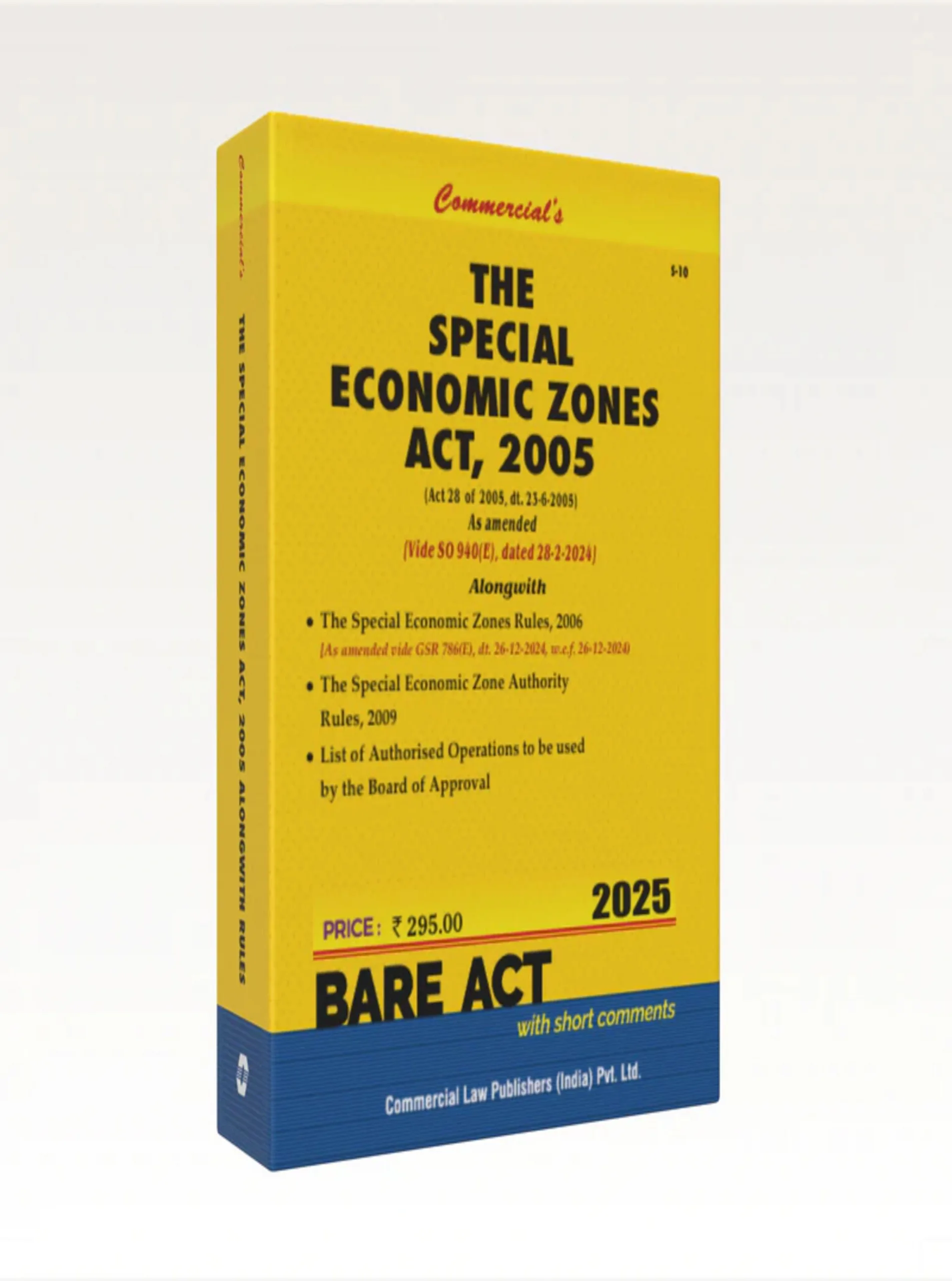

The Special Economic Zones Act, 2005

₹295.00 Original price was: ₹295.00.₹236.00Current price is: ₹236.00.

This book presents the Special Economic Zones Act, 2005, a key legislation enacted to promote exports, attract foreign investment, and boost economic growth in India. It outlines the legal framework governing the establishment, operation, incentives, and regulatory control of Special Economic Zones. The publication serves as an essential statutory reference for understanding SEZ governance and compliance.

In stock

You may also like it

-

The Criminal Law (Amendment) Act, 2018

₹130.00Original price was: ₹130.00.₹104.00Current price is: ₹104.00. -

The Companies Act, 2013 (AIBE)

₹495.00Original price was: ₹495.00.₹396.00Current price is: ₹396.00.

The Special Economic Zones Act, 2005 was enacted to provide a comprehensive legal framework for the establishment, development, and management of Special Economic Zones (SEZs) in India. This book offers an authoritative and structured presentation of the Act, enabling a clear understanding of the policy objectives, regulatory mechanisms, and incentives associated with SEZs.

The legislation aims to promote exports, attract domestic and foreign investment, generate employment, and develop world-class infrastructure. It provides tax and fiscal incentives to developers and units operating within SEZs while laying down regulatory oversight mechanisms through designated authorities. The Act also streamlines customs, taxation, and administrative procedures to ensure ease of doing business within SEZs.

This publication is particularly useful for legal professionals, corporate advisors, policymakers, and students dealing with trade and investment laws. Its clear statutory layout allows quick reference to compliance requirements, operational norms, and incentive structures. Whether used for advisory work, academic study, or regulatory compliance, this book remains a vital resource in India’s commercial and economic law framework.

Featured Products

Important Civil Acts covering 15 Acts

🔥 4 items sold in last 7 days

Criminology & Penology

🔥 5 items sold in last 7 days

Interpretation of Statutes

🔥 7 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.